this post was submitted on 04 Mar 2025

375 points (98.4% liked)

Canada

8265 readers

2791 users here now

What's going on Canada?

Related Communities

🍁 Meta

🗺️ Provinces / Territories

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Northwest Territories

- Nova Scotia

- Nunavut

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

- Yukon

🏙️ Cities / Local Communities

- Calgary (AB)

- Edmonton (AB)

- Greater Sudbury (ON)

- Guelph (ON)

- Halifax (NS)

- Hamilton (ON)

- Kootenays (BC)

- London (ON)

- Mississauga (ON)

- Montreal (QC)

- Nanaimo (BC)

- Oceanside (BC)

- Ottawa (ON)

- Port Alberni (BC)

- Regina (SK)

- Saskatoon (SK)

- Thunder Bay (ON)

- Toronto (ON)

- Vancouver (BC)

- Vancouver Island (BC)

- Victoria (BC)

- Waterloo (ON)

- Windsor (ON)

- Winnipeg (MB)

Sorted alphabetically by city name.

🏒 Sports

Hockey

- Main: c/Hockey

- Calgary Flames

- Edmonton Oilers

- Montréal Canadiens

- Ottawa Senators

- Toronto Maple Leafs

- Vancouver Canucks

- Winnipeg Jets

Football (NFL): incomplete

Football (CFL): incomplete

Baseball

Basketball

Soccer

- Main: /c/CanadaSoccer

- Toronto FC

💻 Schools / Universities

- BC | UBC (U of British Columbia)

- BC | SFU (Simon Fraser U)

- BC | VIU (Vancouver Island U)

- BC | TWU (Trinity Western U)

- ON | UofT (U of Toronto)

- ON | UWO (U of Western Ontario)

- ON | UWaterloo (U of Waterloo)

- ON | UofG (U of Guelph)

- ON | OTU (Ontario Tech U)

- QC | McGill (McGill U)

Sorted by province, then by total full-time enrolment.

💵 Finance, Shopping, Sales

- Personal Finance Canada

- BAPCSalesCanada

- Canadian Investor

- Buy Canadian

- Quebec Finance

- Churning Canada

🗣️ Politics

- General:

- Federal Parties (alphabetical):

- By Province (alphabetical):

🍁 Social / Culture

Rules

- Keep the original title when submitting an article. You can put your own commentary in the body of the post or in the comment section.

Reminder that the rules for lemmy.ca also apply here. See the sidebar on the homepage: lemmy.ca

founded 4 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

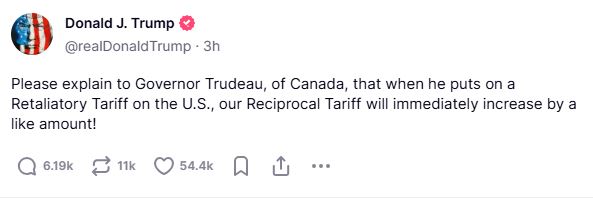

The real problem is that Trump's supporters don't understand tariffs, and wouldn't believe the explanation anyway because to them it just sounds like Orange Man Bad.

When the US imposes a tariff on Canada, importers of Canadian goods pay the tariff to the US government. To recover that cost they raise the prices they charge American customers. So Americans end up paying the tariff. The only damage it does to Canada is that the tariff could discourage US importers from buying certain goods from Canada if they can get them somewhere else without paying a tariff. That happens in some cases, but in others Canada is already the cheapest (or only) source of a high-demand item, so Americans will just pay the higher prices - the way they're still paying jacked-up COVID prices for so many things, for example.

Millions of Americans, being too dumb or unwilling to grasp this, think these tariffs are Trump heroically saving them from the evils of foreigners who want to destroy their Freedom.

Just tell them it's a 25% sales tax.

Reports from people who know him, Trump is one of these people. He clearly doesn't understand the process.

“I’ve been in the room when it’s been explained to him, and he doesn’t understand it, but he likes tariffs,” Bolton said.

not to mention any potential compound tariffs on complex goods likes automobiles for example.

Prices skyrocket immensely.

The housing market is only going to get more expensive, etc.

By compound tariffs, do you mean extra tariff fees due to repeated trips across the border in the manufacturing process?

Ya. I watched the Doug Ford announcement, and he said parts can cross the Ontario border up to 8 times before making it into the vehicle or final product.

so $10 part -> $12.50 -> $15.625 -> $19.531 -> $24.414 -> $30.517 -> $38.146 -> $47.683 -> $59.60

So that $10 part from the first factory is now $59.60 and that's before the fact that it probably increases in value at each step along the way to being refined into it's final product.

Thats why he's saying (as well as others) that they expect the factories on both sides to shut down within a couple weeks.

Edit: half of that if it's a one way tariff where both sides didn't put tariffs on the exact same items.

The areas where they overwhelmingly voted for the orange dumbass are in for a shock. Here is a list of the products that canda has put tariffs on.

https://www.canada.ca/en/department-finance/news/2025/03/list-of-products-from-the-united-states-subject-to-25-per-cent-tariffs-effective-march-4-2025.html

Combined with a strong dollar that's a huge blow to U.S. agriculture and manufacturing. FYI U.S. Agriculture is in the worst overall depression of the past 50 years. The strong dollar has basically has given the entire industry a beating.

Just wait until our first harvest season without immigrants!

Obviously it's the deep liberal swamp state's fault. Trump's going to make Canada pay for it.

Tariffs, and other taxes, are not entirely passed to the consumer. The producers are also losing money because they're selling less. Taxes are paid both by the consumer and the producers, the proportion on how much each part pay is unknown for me.

Let's say a bottle of Canadian Maple Syrup is $5 before.

25% Tariff is $1.25

Let's say the company makes $2 on each bottle before tariff. They really need to make $2 per bottle to cover expenses

So if a company still wants to make $2 a bottle still.

If they sell for $6.25 to try to cover the tariff (25% increase)

The tariff becomes $1.56

Instead of making $5, they would make $4.69.

Instead of $2, they would make $1.69

If they sold the bottle for $5, paid $1.25 tariff

They would make 75 cents

The number for $5 is $6.67

If the company sold the syrup bottle for $6.67. Payed $1.67 in tariff (25%). They would make $2.

Now, of course, they want to sell it for $6.67. Will people pay the increased price?

They can't just keep selling them for $5 and make basically a 1/3 of their previous profit.

Prices have to go up. How much is up to the consumer.

If the consumer is willing to buy Official Canadian Maple Syrup 🍁 for $6.67. The consumer is paying the whole $1.67 tariff.

An interesting thing happens when people pay $8. The syrup company makes an extra $1, Government gets $2 tariff. It's a win for everyone, but the consumer that lost $3. (Kind of scary if Trump gets a Maple Syrup company in Canada, goes around, ignores, or pays himself the tariff and sells a bottle for $5. Both are true Canadian Maple Syrup, it just has his name on it. Are you going to buy the $5 or the $8? Even if you buy the $8, he gets $2)

The consumer can't win. Free economy is better.

~33% increase covers a 25% tariff

If the price settles at $6.

Company pays 50 cents

Consumer pays $1

Trump gets $1.50

Who even is in charge of the "tariff funds"?

Like people are happy with having to pay $1 to get the company to pay 50 cents? Like that's a win?

Sad reality is Americans should not buy anything with a tariff. Paying a premium to help support Canada seems like a good thing but if everyone does it and everyone pays 33% more. The tariff funds makes out like a bandit all thanks to the consumers.

TL;DR: Company facing a 25% tariff will look to raise prices 33%. If they can they are fine or better. Consumers lose. I really like Vermont Maple Syrup

Would you mind changing "instead of making, they make" by some other precise verbs? Your explaination seems very interesting but, probably du to my poor english, I feel like you saying the same thing over and over while changing the numbers and I can't grasp your explanation.

So if a company still wants to make $2 profit per bottle.

Company raises price to $6.25 to try to cover the tariff (25% increase)

The tariff becomes $1.56 ($6.25 × 25%)

Instead of selling for $5 price, they would sell it for $4.69 effectively ($6.25-$1.56)

Instead of making $2 profit, they would make $1.69 profit ($4.69-$3(production cost))

If they still sold the bottle for $5, paid $1.25 tariff

They would make 75 cents of profit ($5-$3(production cost)-$1.25(tariff))

I see. Since the tarif is proportionate to the final price, the final price needs even higher than the initial price times (1 + tarif) in order to keep the profit the same.

Starting Price / (1-Tariff %) = Final Price Needed to Break Even

$5 / (1-.25) =

5/.75 = $6.67

If an item was $5 and there was a 30% tariff

5 / (1-.30) = $7.14

If there was a 30% tariff and the syrup company wanted to keep same profit they would have to sell each bottle for $7.14.

$7.14 × .30 = $2.14

$7.14 - $2.14 = $5

No, because (1 + tariff) isn't enough to keep up with the tariff because as the price goes up, the tariff also goes up.

Like in the example going from $5 to $6.25 (5 × (1+.25)). Would result in 31 cents less per bottle.

It needs to be ~33% more or $6.67 for the syrup company to keep the same profit with a 25% tariff.

Final Price × Tariff % = Tariff Amount

Final Price - Tariff Amount = Cost of Good Sold

Cost of Good Sold - Expenses = Profit

So if you need $2 profit

$2 = (Final Price - (Final Price × Tariff %)) - Expenses

$2 = (X - (X×.25)) - $3

$5 = X - .25X

$5 = .75X

X = $6.67

Formula would be

Profit = (Final Price - (Final Price × Tariff %)) - Expenses

Thanks !

No problem!