this post was submitted on 12 Jun 2025

101 points (97.2% liked)

Data is Beautiful

2830 readers

1 users here now

Be respectful

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

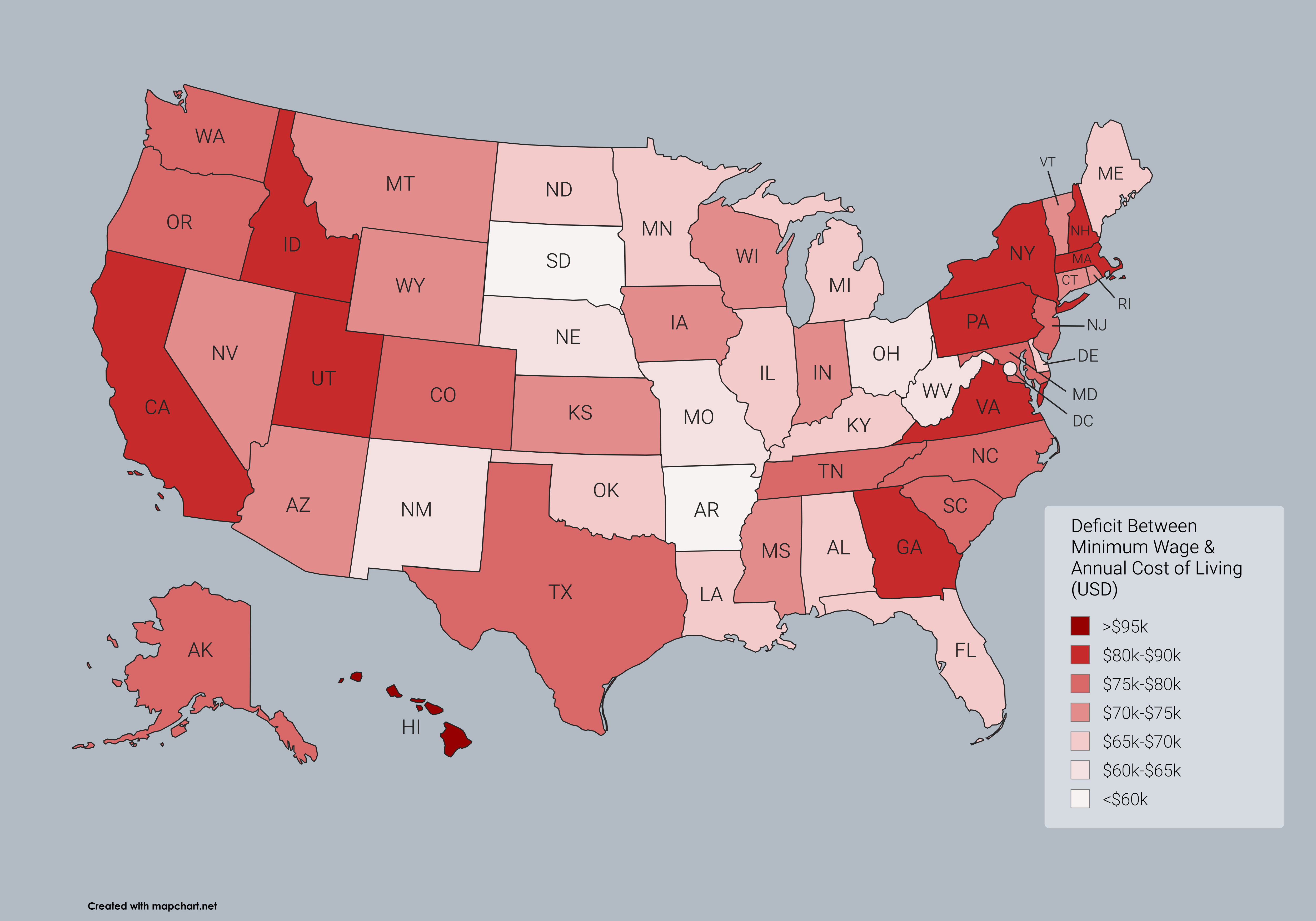

My map is based off of SmartAsset’s 2025 cost of living calculations, which assume a healthy financial breakdown of 50/30/20 of expense, discretionary, and savings percentages.

They offer info for single individuals and for a family of four. My “calculations” for the map are based on their single individual cost of living calculation, and a single individual earning minimum wage full time. And yes, deficit as in cost of living minus what a minimum wage earner actually makes.

I agree its possible to survive on less, however, surviving and having healthy finances are two different things. Although that should be obvious given the numbers we see on the map, considering how many people are surviving on $10-$20 per hour. 50/30/20 is what everyone should be aspiring to, and be better setup to feasibly achieve IMO.

And of course, state averages are certainly averages. It wont represent the actual cost of living in all areas of the state

I was indeed "barely" getting by but I'm still shocked to see 115k. I don't even make that now and I live very comfortably

Not trying to put down your work at all! I'm just very confused by the data. Are the handful of rich cities really skewing the average that much?

Of course! I didnt mean to imply you were trying to put me down.

Digression

I think the largest thing skewing the averages in most states is probably housing costs. The cost of rent or financing a house is pretty unrealistic anywhere near minimum wage in most places, or even at whatever the bottom of the market actually is in any given area (even if well above legal minimum wage).Housing should be a bit over 30% of income, so of the 50% of their breakdown in cost of living calculations should be 33% towards rent and 17% to cover literally everything else thats a necessary expense, plus taxes I would assume. That 17% has to do a lot of heavy lifting if you will also have half of your income going to fun stuff and saving money.

Realistically I think many people are stuck with something like 33% on rent, 33% on everything else necessary, and 33% on discretionary shit so they dont off themselves due to bleak life outlook. I know thats where I was at for the first 10 years of my working life